The COVID-19 pandemic has caused significant business disruption and could prove to be the biggest challenge financial institutions have faced in nearly 100 years.

The target federal funds rate returned to the zero lower bound in March 2020 after two emergency, unscheduled meetings amid the global coronavirus outbreak with short-term interest rates lowered 150 bps in less than two weeks.

Additionally, market discussion of a negative interest rate policy scenario has returned. To provide support and stability to the financial markets, the Fed has committed to unlimited asset purchases in addition to the launch of a total of ten liquidity and lending programs. The Fed has noted there is more officials can do. Along with the monetary policy response, Congress passed an unprecedented fiscal package in March to help support economic activity.

A second round of fiscal stimulus is likely to be considered by the White House to provide further economic support.

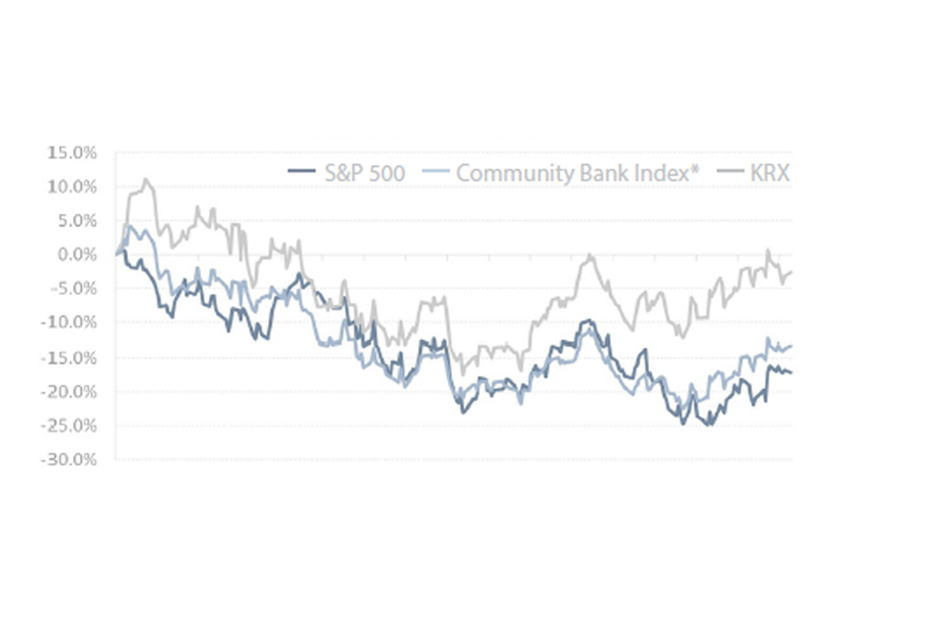

Financial markets were extremely volatile from late February through April but have since stabilized. Equity-market sentiment is already looking towards an economic recovery.

Rating agencies turned negative in their outlook for the banking industry citing concerns on the financial impact of the coronavirus. Earnings pressure is expected due to margin compression and material increase in credit costs. Strong capital positions will provide a cushion if credit quality deteriorates in a prolonged — and potentially severe — economic slowdown.

The number of banks headquartered in the Tenth District has declined 66% since 1990. But the amount of assets has still grown by more than $210 billion, as shown in the graph below.

Resources and Latest News

Whether you want to watch, listen or read, we have content that fits your preferences.

All Resources